Over the past decade, ESG principles have moved from being a peripheral concern to a central issue in how banks manage risk, shape their corporate strategies, and engage with customers and investors. As governments, regulators, and the public place greater emphasis on sustainability and ethical practices, banks are increasingly integrating ESG into their core operations to remain competitive and relevant.

In the UK, ESG is now a crucial part of the financial services sector, driven by regulatory changes, investor demand, and the global push towards addressing climate change and social inequalities. This article explores the impact of ESG on the banking sector, how it is reshaping the industry, and the role of professional courses in equipping bankers with the skills needed to navigate this rapidly evolving landscape.

ESG refers to the three key areas—environmental, social, and governance—that are used to assess a company's ethical and sustainable practices. These factors provide a framework for evaluating a company’s long-term impact on society, the environment, and its internal governance structures. Here’s a brief breakdown:

Environmental: How a company impacts the environment, including its carbon footprint, energy use, waste management, and contribution to climate change.

Social: How a company manages relationships with employees, suppliers, customers, and communities. This includes issues such as labour rights, diversity and inclusion, and community engagement.

Governance: The internal systems and controls that govern the company, including board composition, executive pay, transparency, and shareholder rights.

The banking sector is uniquely positioned to drive the ESG agenda. As key players in the global financial system, banks not only influence their own practices but also have the power to shape the behaviour of businesses and industries through lending, investment, and advisory services.

Several factors are driving the integration of ESG into banking operations:

In the UK, regulators such as the Financial Conduct Authority (FCA) are placing increasing emphasis on ESG. The FCA’s Climate Financial Risk Forum (CFRF) and the Task Force on Climate-related Financial Disclosures (TCFD) are two major initiatives that require banks to assess, disclose, and mitigate climate-related risks.

Additionally, the UK government’s commitment to achieving Net Zero emissions by 2050 has spurred banks to align their lending and investment portfolios with sustainable practices. This means banks must carefully consider the environmental impact of the companies they finance and the long-term risks posed by climate change.

The Sustainable Finance Disclosure Regulation (SFDR), which applies across the European Union and has implications for UK banks post-Brexit, also mandates greater transparency on how banks integrate ESG factors into their investment strategies. UK banks are under pressure to adhere to these standards to remain competitive and compliant in the global marketplace.

Investors are increasingly looking to put their money into companies that demonstrate strong ESG credentials. According to a report by the Global Sustainable Investment Alliance (GSIA), global sustainable investment reached over £30 trillion by 2020, and this trend is set to grow.

Banks must respond to this demand by offering ESG-focused financial products and services. Sustainable bonds, green loans, and ESG investment funds have seen rapid growth as more investors seek to align their portfolios with ethical and sustainable practices. For example, sustainability-linked loans (SLLs), which offer favourable lending terms to borrowers that meet specific ESG targets, have become an essential tool for banks seeking to promote sustainability.

Failure to address ESG concerns can result in banks losing market share to competitors that prioritise ESG, as investors, customers, and regulators increasingly demand transparency and accountability in how financial institutions operate.

ESG factors are now critical components of risk management for banks. Climate change, social unrest, and governance failures all pose significant risks to the stability of financial systems. For example, banks that invest heavily in carbon-intensive industries may face losses as these sectors become increasingly regulated or phased out in favour of greener alternatives.

By integrating ESG considerations into their risk management frameworks, banks can better anticipate and mitigate these risks. Climate risk, in particular, has become a focal point for banks, with many now assessing the physical risks (e.g., damage to assets from extreme weather) and transition risks (e.g., the impact of shifting to a low-carbon economy) associated with their lending and investment portfolios.

Incorporating ESG into risk management also helps banks avoid reputational damage. Public scrutiny of environmental and social issues is growing, and banks that are seen as complicit in financing unsustainable or unethical practices can face significant backlash from consumers and advocacy groups.

Beyond regulatory compliance and risk management, ESG provides banks with an opportunity to drive positive change. By aligning their lending and investment strategies with sustainable practices, banks can play a critical role in financing the transition to a greener, fairer economy.

Many UK banks have committed to sustainable finance initiatives, such as Barclays’ commitment to achieving net-zero emissions across its operations and lending portfolios by 2050. Banks are also increasingly offering products like green bonds, which fund environmentally friendly projects, and social bonds, which finance initiatives aimed at improving social outcomes.

Through their advisory services, banks can also guide corporate clients in improving their ESG practices. Banks are well-positioned to help businesses navigate complex ESG regulations and develop strategies that align with investor expectations and regulatory requirements.

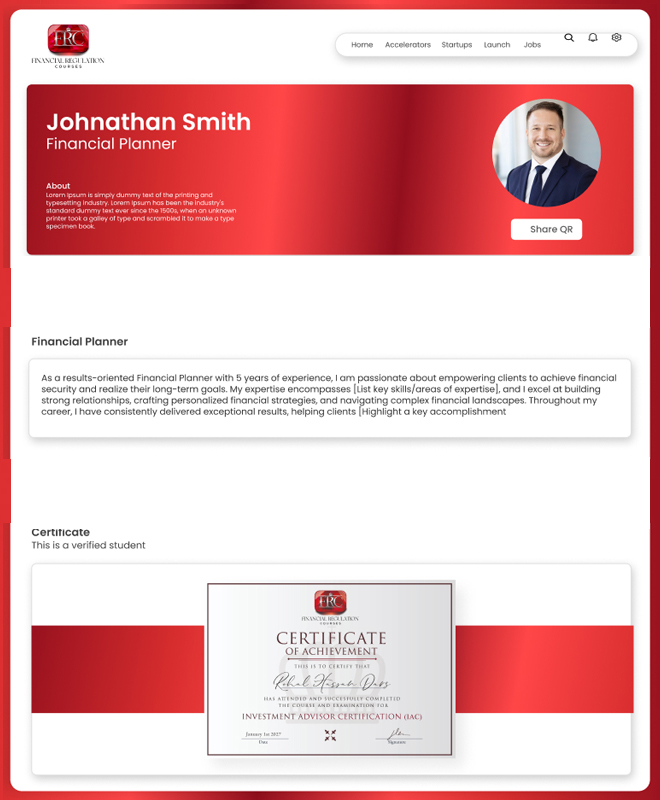

As ESG becomes a central component of banking operations, there is a growing demand for professionals who possess a deep understanding of ESG principles and their application in financial services. Professional courses in ESG, such as those offered by Financial Regulation Courses, equip bankers with the skills needed to meet this demand.

One such course, the ESG Advisor Certificate, offered by Financial Regulation Courses, is designed to provide finance professionals with a comprehensive understanding of ESG regulations, sustainable finance, and how ESG factors are integrated into banking operations. The course covers key topics such as:

Sustainable Finance: Understanding how banks can finance sustainable projects and align their lending portfolios with ESG goals.

Climate Risk Management: Learning how to assess and mitigate climate-related risks in lending and investment decisions.

ESG Reporting and Disclosure: Gaining the skills needed to meet regulatory requirements, such as those set by the FCA and TCFD, for transparent ESG reporting.

Social Impact and Governance: Understanding how social and governance factors, such as labour rights and board diversity, affect risk and investment decisions.

By completing courses like the ESG Advisor Certificate, banking professionals can develop the expertise needed to lead ESG initiatives within their organisations and provide clients with the advice they need to align their business practices with sustainable goals.

While the integration of ESG into the banking sector has seen significant progress, it is not without challenges:

Data and Reporting: One of the biggest hurdles banks face is the lack of consistent and reliable ESG data. Many companies do not have the systems in place to accurately measure and report on ESG factors, making it difficult for banks to assess the sustainability of their investments and loans.

Balancing Profit with Purpose: There can be a tension between generating short-term profits and making long-term investments in sustainability. Banks must strike a balance between meeting shareholder expectations and investing in ESG initiatives that may take time to deliver financial returns.

Standardisation: The lack of global standardisation in ESG regulations creates complexities for banks operating across multiple jurisdictions. Different countries have different reporting standards and expectations, making it challenging for banks to align their global operations with ESG goals.

ESG is no longer a niche consideration for the banking sector—it is now a core component of how banks manage risk, engage with stakeholders, and drive positive societal change. In the UK, regulatory pressures, investor demand, and the need for robust risk management have placed ESG at the forefront of banking strategies.

Banks that successfully integrate ESG into their operations stand to benefit from enhanced reputational value, reduced risk exposure, and access to a growing market for sustainable finance. However, the shift towards ESG also presents challenges, particularly in areas such as data collection and balancing short-term profits with long-term sustainability goals.

Professional courses, such as the ESG Advisor Certificate by Financial Regulation Courses, are essential for equipping banking professionals with the knowledge and skills needed to navigate this evolving landscape. As the demand for sustainable finance grows, bankers with ESG expertise will be well-positioned to lead the sector into a more sustainable future.

Be the first to know about new class launches and announcements.

Financial writer and analyst Ron Finely shows you how to navigate financial markets, manage investments, and build wealth through strategic decision-making.