In the banking sector, the integration of ESG principles has not only redefined business strategies but also reshaped how banks assess risk, offer financial products, and engage with regulators and investors. ESG is no longer seen as an optional or peripheral concern; it is now a core element that influences everything from corporate lending to investment decision-making.

In the UK, ESG’s rise has been driven by regulatory requirements, shifting market demands, and growing societal awareness of sustainability. With mounting pressure from both the government and consumers to prioritise ethical and sustainable practices, banks are now at the forefront of this transformation. This article examines how ESG has impacted the UK banking sector and highlights the importance of ESG education for finance professionals.

Environmental, Social, and Governance factors collectively represent a framework used to evaluate a company’s ethical standards and sustainability practices. These criteria have become fundamental in the banking sector for several reasons:

Environmental (E): Banks are increasingly being judged on their environmental impact, such as their involvement in financing carbon-intensive industries. Managing exposure to climate-related risks, like carbon emissions and environmental degradation, is becoming essential for banks.

Social (S): The social aspect of ESG focuses on a bank’s relationships with its employees, customers, and the wider community. This includes issues like diversity and inclusion, fair wages, human rights, and ethical lending practices.

Governance (G): Strong governance is the foundation of ESG, focusing on transparency, executive remuneration, board diversity, and ethical decision-making. Good governance helps mitigate risks related to corruption, fraud, and poor leadership.

The integration of ESG into banking not only reflects the sector’s growing commitment to sustainability but also recognises the financial materiality of these factors. Banks that fail to adopt ESG principles risk reputational damage, regulatory penalties, and losing investors and clients who prioritise ethical and sustainable practices.

Several factors have contributed to the integration of ESG principles in the UK’s banking sector. These include regulatory pressure, investor demand, reputational risks, and the desire to create long-term value.

Regulators in the UK have played a significant role in promoting ESG in the banking sector. The Financial Conduct Authority (FCA), for instance, has introduced rules that require banks to disclose their climate-related risks in alignment with the Task Force on Climate-related Financial Disclosures (TCFD) guidelines. The UK government’s Net Zero by 2050 goal also adds further pressure on banks to align their portfolios with sustainable practices.

Moreover, the introduction of the Sustainable Finance Disclosure Regulation (SFDR) in the European Union has implications for UK banks, particularly in terms of increasing transparency about how they integrate sustainability into their financial products. Although the UK has left the EU, many banks continue to operate within European markets and must meet these requirements to remain competitive.

Banks are expected not only to comply with existing ESG-related regulations but also to stay ahead of forthcoming changes, including carbon reduction targets and enhanced climate risk reporting.

Institutional and retail investors are increasingly looking to invest in companies that demonstrate strong ESG credentials. Investors understand that companies, including banks, that integrate ESG principles are more likely to manage risks effectively, secure long-term returns, and safeguard their reputation.

As a result, UK banks are offering a growing number of ESG-related financial products, such as green bonds, sustainability-linked loans (SLLs), and ESG investment funds. These products not only meet investor demand but also support the transition towards a more sustainable economy.

Banks that fail to offer ESG-focused investment opportunities risk losing their competitive edge as more investors, particularly younger generations, prioritise ethical investments. Research indicates that sustainable finance is no longer niche; it is now central to long-term investment strategies.

ESG factors are critical to effective risk management in banking. Climate-related risks, in particular, have become a priority for banks, as extreme weather events, changing regulatory frameworks, and shifting consumer behaviours impact their portfolios.

Physical risks, such as property damage caused by floods or storms, and transition risks, like regulatory changes affecting fossil fuel industries, can result in significant financial losses for banks if not properly managed. As such, many UK banks are incorporating ESG considerations into their credit risk assessments and portfolio management strategies.

Additionally, social risks, such as labour rights violations and diversity issues, can lead to reputational damage if banks are associated with unethical business practices. Strong governance structures are crucial to ensuring that banks remain transparent, accountable, and resilient in the face of these challenges.

In an era of heightened social and environmental awareness, a bank’s reputation is more vulnerable than ever. Consumers are scrutinising the actions of banks more closely, particularly regarding their role in financing environmentally harmful projects or unethical business practices.

A commitment to ESG is essential for maintaining trust and credibility with clients, investors, and the wider public. Banks that integrate ESG principles into their operations not only enhance their reputation but also position themselves as leaders in the sustainable finance movement.

For example, Barclays and HSBC have committed to achieving net-zero emissions across their portfolios, reflecting the importance of aligning their lending and investment strategies with climate goals. By demonstrating leadership in ESG, banks can build stronger relationships with stakeholders and secure long-term success.

The integration of ESG into the banking sector is not just a short-term trend—it is shaping the future of the industry. ESG is influencing how banks make decisions, assess risks, and engage with stakeholders. Several trends are emerging as a result of this shift:

As the demand for sustainable financial products grows, banks are developing new solutions that align with ESG principles. Green bonds, which finance projects with environmental benefits, have become popular instruments for raising capital while supporting sustainability goals. Similarly, sustainability-linked loans (SLLs) incentivise borrowers to meet ESG targets by offering reduced interest rates if specific sustainability goals are achieved.

These products enable banks to play a key role in financing the transition to a greener economy, while also creating new revenue streams.

As part of their regulatory obligations, UK banks are now required to report on their ESG performance and disclose climate-related risks. This trend is expected to continue, with increasing demands for transparency from both regulators and investors.

In the coming years, banks will likely face stricter reporting requirements, including more detailed information on the environmental and social impact of their lending activities. As such, banks will need to invest in systems and processes that enable accurate ESG data collection and reporting.

As ESG becomes more embedded in banking operations, it is also driving changes in corporate culture and governance. Banks are appointing Chief Sustainability Officers (CSOs) to oversee ESG strategy and integrating ESG metrics into executive remuneration packages.

Furthermore, there is growing recognition that diversity, inclusion, and social responsibility are not just ethical considerations but essential to long-term business success. Banks are making strides to improve board diversity, address pay gaps, and promote inclusive workplace cultures.

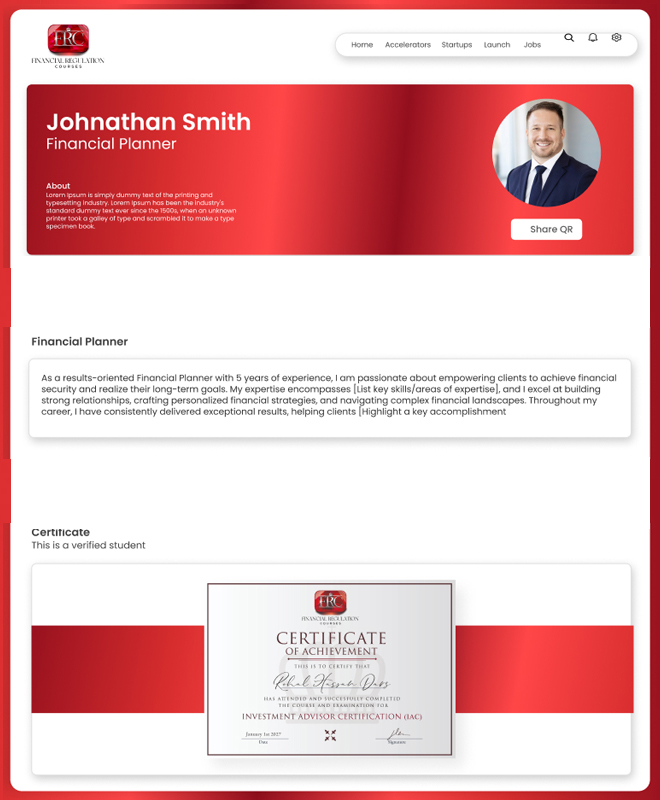

As ESG continues to transform the banking sector, there is an increasing need for professionals who are equipped with the knowledge and skills to navigate this new landscape. Professional courses, such as the ESG Advisor Certificate offered by Financial Regulation Courses, are essential for developing a deep understanding of ESG principles and their application in banking.

The ESG Advisor Certificate covers key topics such as:

Sustainable Finance: Understanding how banks can create and promote sustainable financial products.

ESG Risk Management: Learning to assess and mitigate risks associated with climate change and other ESG factors.

Regulatory Compliance: Gaining insights into the evolving regulatory requirements related to ESG in banking.

Governance and Social Responsibility: Exploring how governance structures and social policies impact ESG performance.

By completing such courses, banking professionals can develop the expertise needed to lead ESG initiatives within their organisations, manage risks effectively, and meet the growing demand for sustainable finance.

ESG is having a profound impact on the UK banking sector, driving changes in how banks manage risk, engage with stakeholders, and develop financial products. Regulatory pressures, investor demand, and the need for strong risk management are all pushing banks to integrate ESG principles into their operations.

As the banking sector continues to evolve, professionals who understand ESG’s complexities and its implications for financial services will be in high demand. Professional courses, such as the ESG Advisor Certificate by Financial Regulation Courses, provide the knowledge and skills needed to thrive in this new era of sustainable finance.

Banks that successfully integrate ESG into their strategies will not only secure long-term financial success but also play a crucial role in driving the transition to a more sustainable and equitable global economy.

Be the first to know about new class launches and announcements.

Financial writer and analyst Ron Finely shows you how to navigate financial markets, manage investments, and build wealth through strategic decision-making.